Yen Spikes On Suspected Intervention Move

Hawkish Hold From BOJ

USDJPY has seen a volatile session so far with price whipsawing around the BOJ meeting. The bank held rates unchanged, as expected, but was firmly hawkish in its outlook signalling the likelihood of further interest rate hikes to come. The bank lifted its growth and inflation forecasts and voiced some concern over labour shortages and the impact this could have on wages, noting that it would be monitoring this dynamic and responding accordingly. While no clear signal was given on the timing of the next expected rate hike, BOJ governor Ueda stress the need to make timely decisions and said that it would not necessarily be relying solely on hard data but also on leading indicators such as corporate surveys.

Intervention Rumours

Given the sharp move we saw in USDJPY around the meeting (plunging around 200 pips), traders suspected intervention by Japanese authorities. There has been plenty of verbal intervention and warnings recently, including Japanese Fin Min Katayama who recently signalled the potential for joint action with the US. While nothing has been confirmed, the timing of the move suggests the likelihood that Japanese authorities were looking to capitalise on any upside JPY reaction in response to hawkish BOJ comments. With USD remaining soft into the weekend. USDJPY has room to correct further near-term though might struggle to see a proper sell off until we see some concrete action from the BOJ.

Technical Views

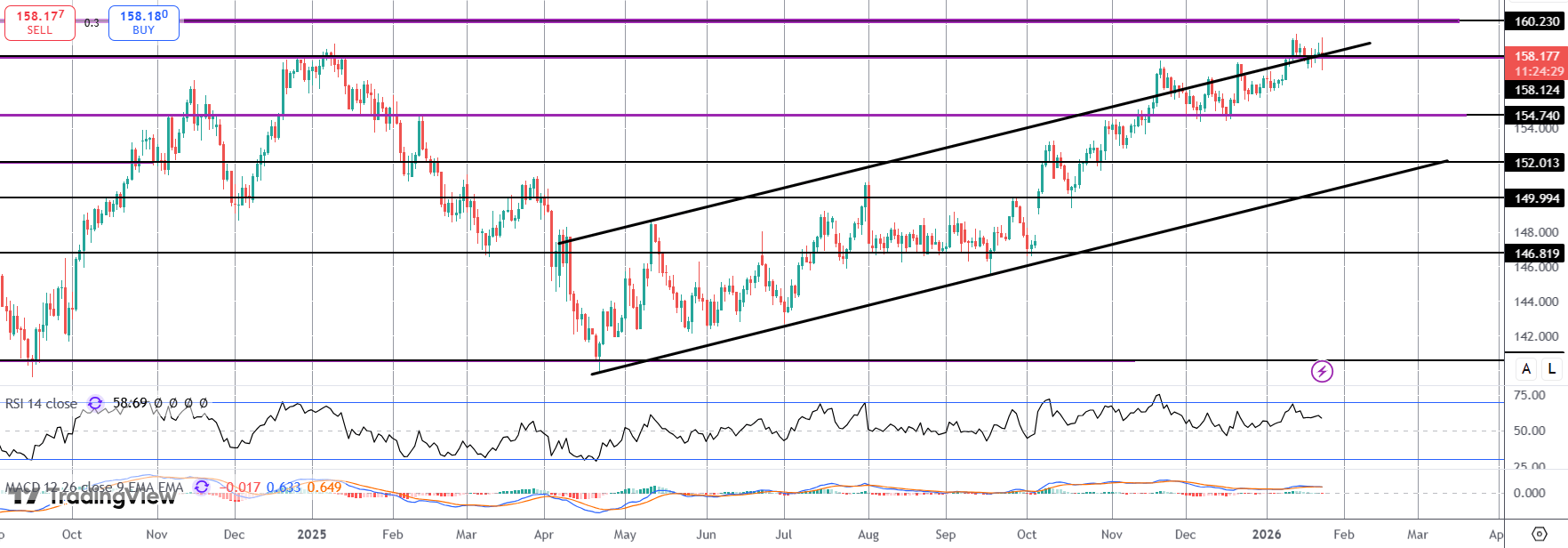

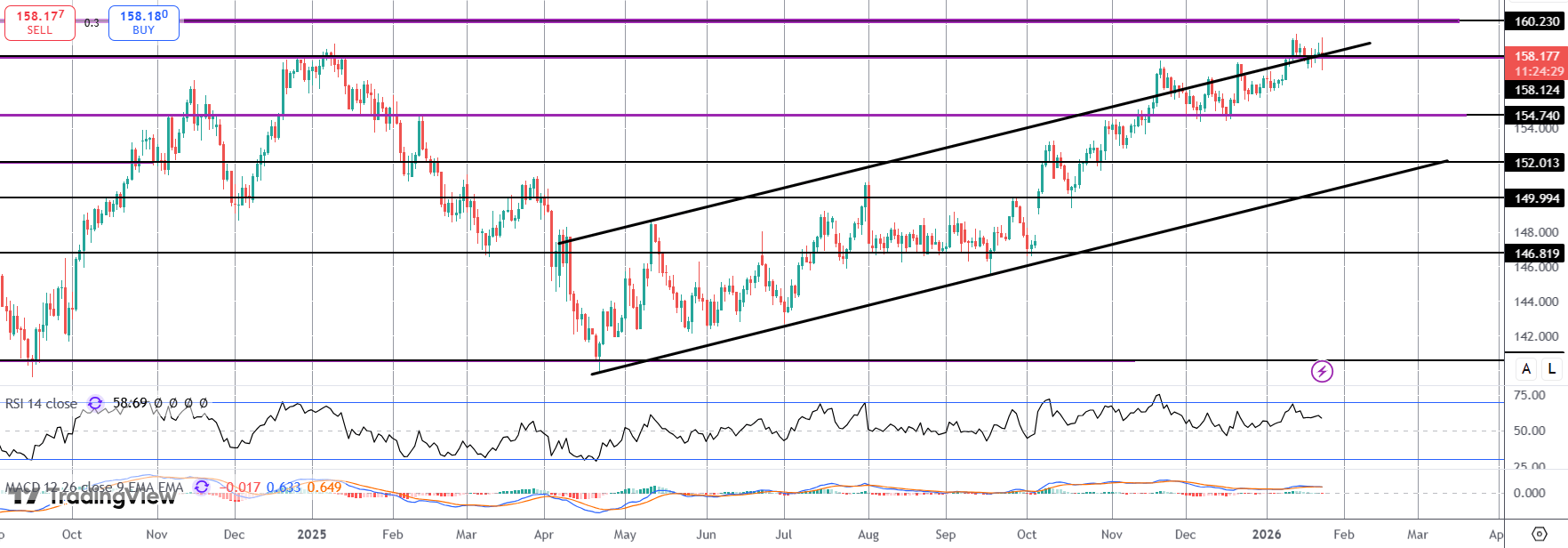

USDJPY

The Rally in USDJPY has stalled for now into the 158.12-level resistance and bull channel highs, with the 160.23 offering further resistance just above. This remains a key resistance area for the market and should we turn lower form here, 154.74 will be the key support level to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.