USDJPY Collapses on Fed Rate-Check News

Fed Rate-Check

USDJPY remains weak today, gapping lower at the open, on the back of heavy selling on Friday in response to the Fed rate-check activity. News started coming through around the London close on Friday that the Fed was asking banks in New York about their position sizes in USDJPY, raising speculation that the bank was/is going to intervene. Speculation around potential joint US/Japanese intervention has been back in the spotlight recently following comments from Japanese Fin Min Katayama a few weeks ago signalling the potential for such a move.

Intervention Rumours

There had been early rumours of intervention from Tokyo around the BOJ meeting on Friday morning following the heavy drop lower we saw in USDJPY. However, that move was stalling ahead of joint-intervention chat hitting markets late afternoon Friday. For now, it appears the prospect alone of such a move has been enough to impact USDJPY lower but the question now is whether the move can continue, if such action doesn’t materialise.

FOMC Up Next

Looking ahead this week, focus will now be on the FOMC meeting on Wednesday with Yen bulls hoping for a dovish skew from the Fed to keep USD pressured lower near-term. While no rate change is expected, USD bears will be looking for Powell to keep the prospect of a March rate-cut alive. With current pricing for a cut at around just 15%, there is plenty of room for USD to push lower if Powell fuels a dovish repricing in rate expectations this week.

Technical Views

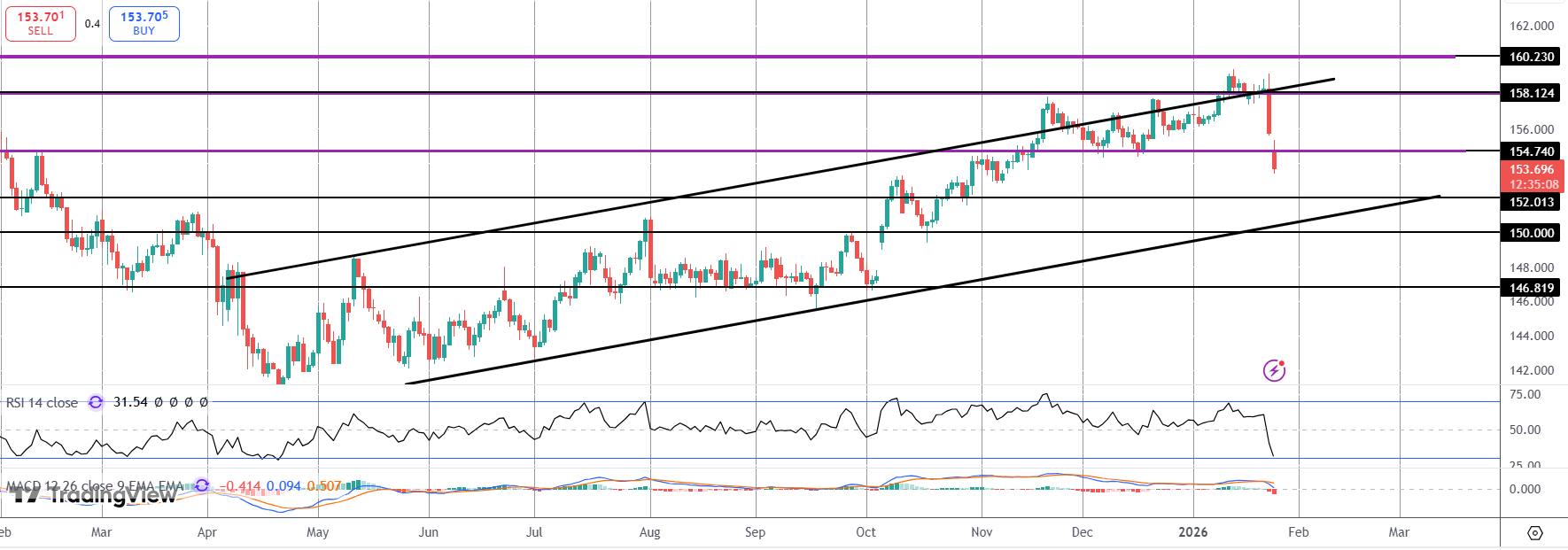

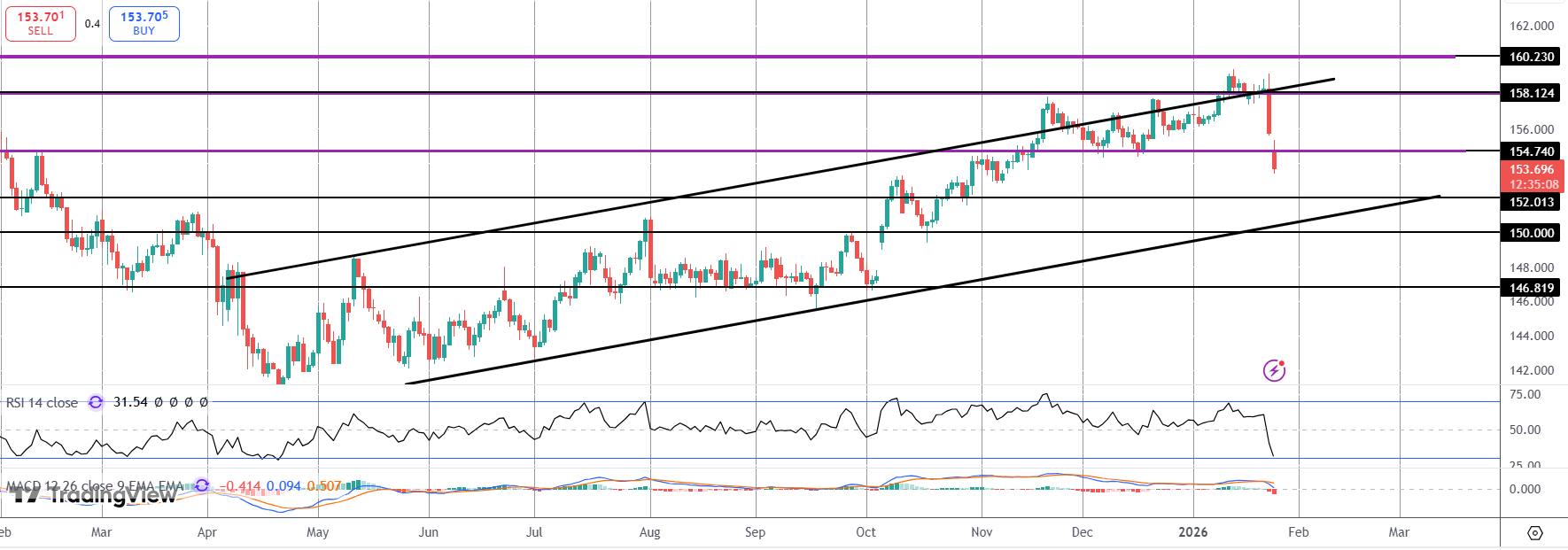

USDJPY

The reversal lower has seen the pair plunging sharply below the 154.74 level, fast approaching a test of 152 next and the bull channel lows. This will be a key support zone for the market with some demand/profit taking likely seen into the channel lows and the 150 level beneath. Any break lower there will turn focus to 146.81 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.