USD Sold Heavily

The US Dollar is coming under heavy selling pressure at the start of the week with the DXY down 0.5% through the European open on Monday. The move comes in response to news that the US government has subpoenaed the Fed and is threatening an indictment of Powell over renovation costs for work on Federal buildings as discussed by Powell at the semi-annual senate banking committee last summer. Powell has called the move an attack on the fed’s independence and markets look to be agreeing so far with USD down sharply across the board today. Trump has long been a vocal critic of Powell mainly for ignoring the president’s call stop cut rates sooner and at a quicker pace. While public insults and threats have been common over Trump’s terms in office, this investigation marks a more sinister turn and has clearly spooked investors. Looking ahead, incoming news flow on the issue will remain key to driving USD this week.

US CPI Due

Away from that story, traders will this week be focusing on incoming US inflation data due tomorrow. Annualised CPI is expected to remain unchanged at 2.7% while monthly data is forecast to show a slight rise in core CPI. If confirmed at these levels, the data should keep near-term Fed easing prospects muted.

Easing Expectations Fall Post-NFP

On Friday, the latest US labour market report showed a drop in the NFP to 50k from 64k prior (itself revised lower to 56k), wages higher to 0.3% from 0.1% prior and the unemployment rate lower to 4.4% from 4.6% prior. Despite the miss on the headline reading, easing expectations fell back after the data with an unchanged decision priced around 95% for this month and a cut in March priced at less than 30% from around 40% prior. While this narrative remains in place USD has room to push higher through Q1 depending on how this Powell investigation story plays out. For now, near-term risks are pointed lower.

Technical Views

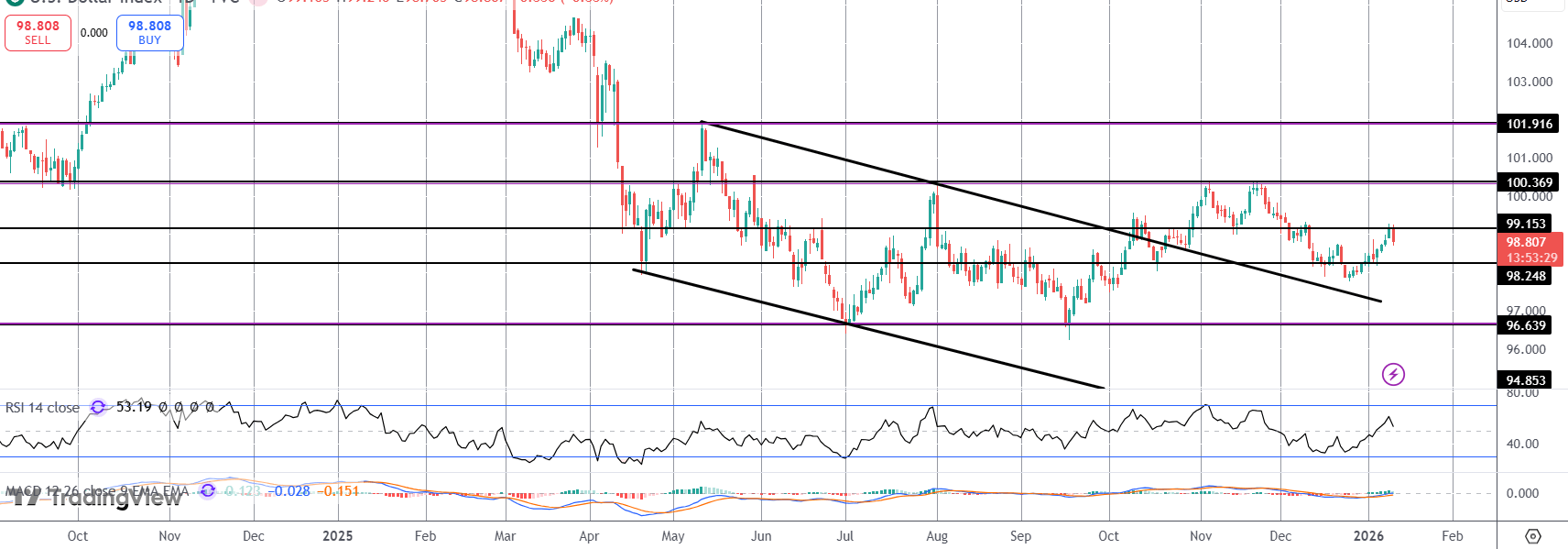

DXY

The failure at 99.15 now risks forming an interim head & shoulders pattern, suggesting room for a heavier downturn. If price breaks below 98.24, focus will be on a deeper push towards 96.63, with a retest of the broken bear channel coming in ahead of that level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.