Gold Now Up +50% in 2025

Gold Rally Continues

Gold prices are starting the day on a softer footing following a fresh surge higher yesterday which saw the futures market expanding further out into record territory. The resumption of the rally over late summer has seen the market surging by more than 20% from the July lows. For the year, gold is now up over 50% and, given the global backdrop of the US government shutdown, continued central bank easing and geopolitical instability linked to Russia and Israel’s military actions, the market looks poised to continue higher.

US Government Shutdown

The US government shutdown continues to drag on without any signs of a forthcoming resolution and while this remains the case, gold prices should continue to find support. USD has been resilient so far, mainly due to shifts lower in JPY and EUR this week. However, should the shutdown continue into next week and beyond, the negative impact on the economy will become unavoidable. The implication here is that the market is likely to turn more dovish on the Fed, sensing an increased urgency to ease further as a result of the shutdown. For now, the shutdown means the NFP data from last month will continue to be delayed. However, with the shutdown expected to weigh heavily on incoming jobs reports from this month, this simply reinforces traders’ dovish Fed expectations and should keep gold prices support near-term with upside amplified if USD starts to resolve lower.

Technical Views

Gold

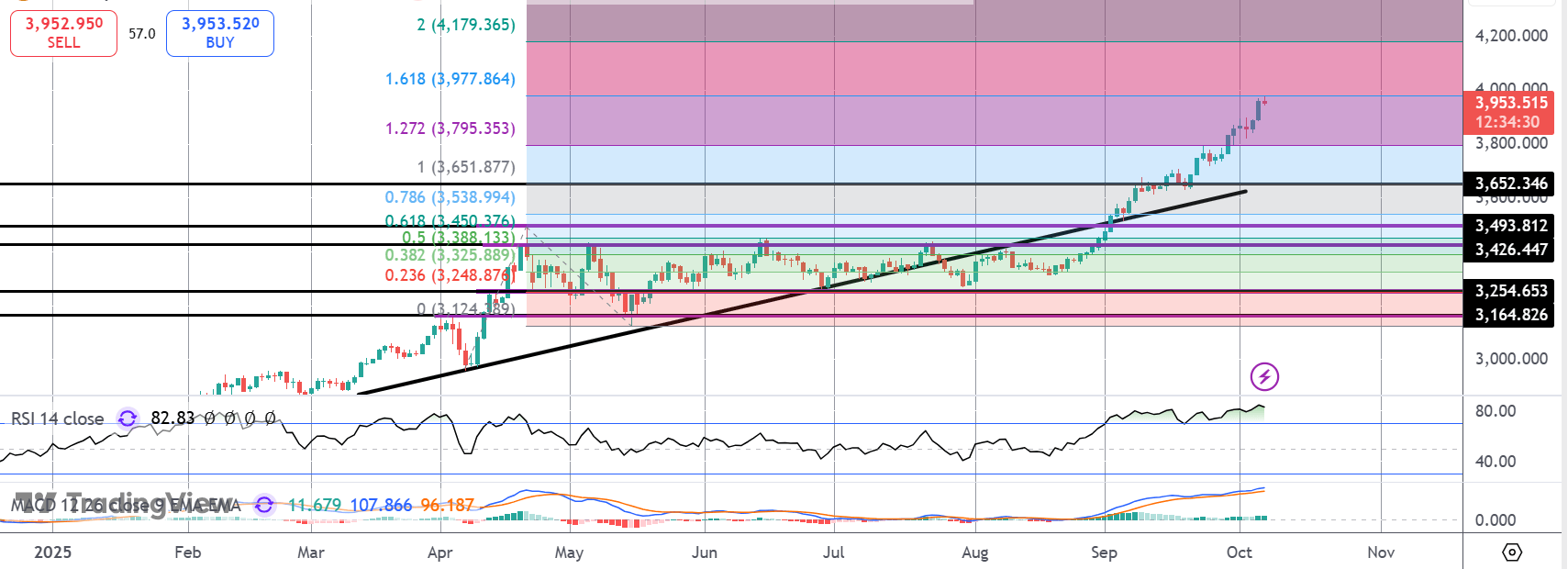

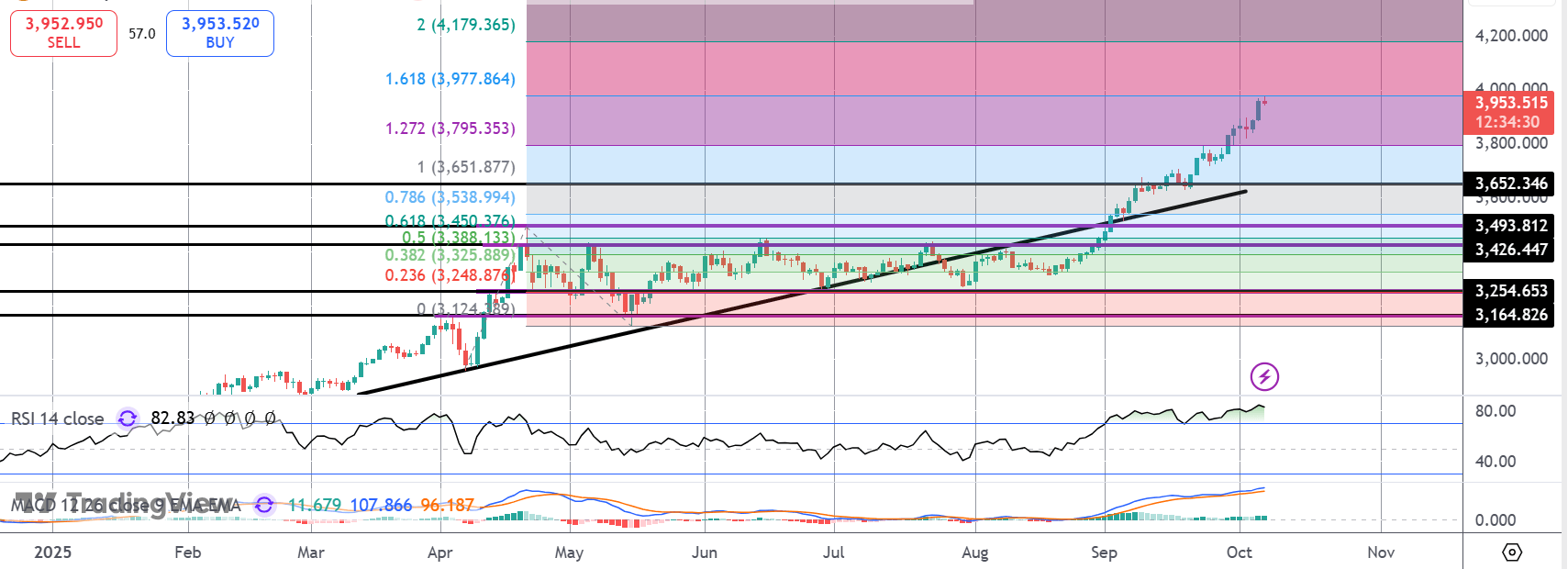

The rally in gold has seen the market trading up to test the 1.61% fib level where price is currently paused. With momentum studies bullish, however, focus is on a continuation higher with the 2% fib level at 3977.86 the next target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.